Telecom Industry Conundrum – The Chronicles of an Unsavory Competition

The telecom industry and data has been one of the hottest topics of late. The data war dates back to 2016 when Reliance Jio Infocomm Ltd., half-owned by India’s richest man, Mukesh Ambani entered the market and relentlessly undercut Vodafone and the other leading carrier, Bharti Airtel Ltd. Vodafone Idea has been struggling to keep its head above water and is lobbying for government intervention to correct a market that’s been skewed by freebies thrown around by Ambani’s Jio.

Back in the day most telecom companies operated under the presumption that data was going to remain an expensive commodity. Basically, they were convinced that they could charge customers exorbitant rates to provide calling and internet services and that this would continue to be the status quo for the foreseeable future. So they sold expensive plans, offered bare minimum services and were happy to continue enjoying their time. On the other end, they were also overpaying for almost everything majorly in the form of charges to the government.

One important aspect to understand is the role

that the spectrums play in the telecom industry. The government allocates

spectrum based on which company is willing to pay the highest for the spectrum.

More frequencies meant more business potential, hence,

it was impertinent for the companies to bag the spectrums for their survival. Most

Telcos were making their bids for these airwaves based on the future cash flow

projections without factoring in Jio. Basically, everybody thought they could

continue to fleece customers and Mukesh Ambani was simply an afterthought.

One important aspect to understand is the role

that the spectrums play in the telecom industry. The government allocates

spectrum based on which company is willing to pay the highest for the spectrum.

More frequencies meant more business potential, hence,

it was impertinent for the companies to bag the spectrums for their survival. Most

Telcos were making their bids for these airwaves based on the future cash flow

projections without factoring in Jio. Basically, everybody thought they could

continue to fleece customers and Mukesh Ambani was simply an afterthought.

In fact, they weren’t paying for

all this because their investors were pumping in their own money. No. They were

paying for all this by borrowing ridiculous sums of money that required them to

extract even more money from their future customers. Airtel, for instance, was

borrowing 1.5 Rs for every rupee their owners put up. Vodafone too was up to something similar. And yes, they could have done all of this and still thrived,

if it weren’t for Jio. Lenders said they will have no recourse should Vodafone Idea default on its payment

obligations to the government. The company may end up being the biggest

non-performing asset (NPA) for lenders because of

the lack of securities, guarantees or

fresh equity from promoters.

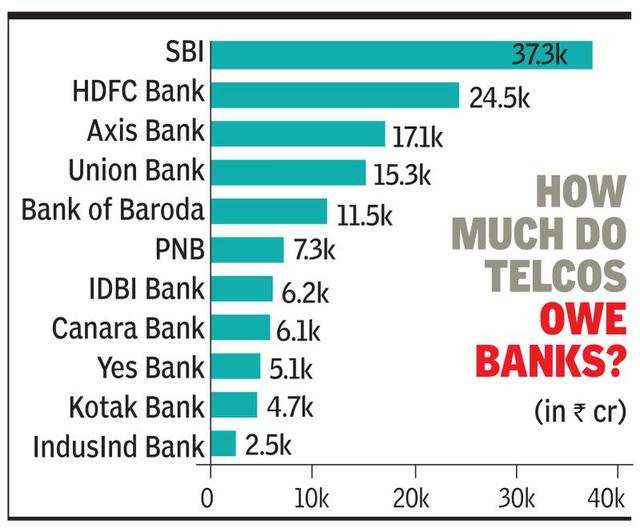

Banks currently have an exposure of close to Rs 1,00,000 crore to Vodafone in fund and non-fund based

agreements. A large part of which is in the form of bank guarantees as capital

expenditure was limited and most of the expenses were on account of payments to

government (Rs. 27,160Cr. in license fees, Rs. 16,540Cr. In Spectrum charges

and Rs. 33,010 for Interest, penalty and interest on Penalty).

In late 2016, when Jio

finally entered the market with its low-cost plans and those future projections

they made earlier went for a toss. Jio disrupted the market in a big way and in

response they tried to revive their operations. But paying off debt isn’t easy.

Not when you were losing customers en masse. So Vodafone started burning it’s

cash reserves, piling itself on more debt to keep things going and is now

staring at a pretty bleak future. But can it get any worse than this?

It did. The Supreme Court's decision on October 24 in favor of DoT (department of telecommunications) turned out to be a death knell for the telecom sector. 15 Telecom companies were asked to pay close to 92,000 crores to the government, of which Airtel and Vodafone were asked to pay Rs. 20,000 Cr. each, whereas Jio was supposed to pay only Rs. 13 Cr. The issue dates back to a contentious topic regarding what part of their revenues telcos were legally obliged to pay as government fee. The decision will have a far-reaching impact on the sector, which is already battling with prolonged tariff wars and high debt burden. The profitability of incumbents is seriously under constraint.

It did. The Supreme Court's decision on October 24 in favor of DoT (department of telecommunications) turned out to be a death knell for the telecom sector. 15 Telecom companies were asked to pay close to 92,000 crores to the government, of which Airtel and Vodafone were asked to pay Rs. 20,000 Cr. each, whereas Jio was supposed to pay only Rs. 13 Cr. The issue dates back to a contentious topic regarding what part of their revenues telcos were legally obliged to pay as government fee. The decision will have a far-reaching impact on the sector, which is already battling with prolonged tariff wars and high debt burden. The profitability of incumbents is seriously under constraint.

The ruling poses significant survival concerns

for VIL with an exhausted balance sheet as FY20 Net Debt to EBITDA ratio

is at 31x, and accounting for dues being funded via debt would raise it to 38x. Long story short, the Supreme Court sided with the government

and said that the telecom companies had to pay a whole lot more than what

was already paid.

Industry body Cellular

Operators Association of India (COAI) on Monday wrote to telecom minister Manoj

Sinha, urging that the Rs 35,000 crore input tax credit due to telcos from the

government be adjusted against spectrum payments and levies as a measure to

help carriers overcome financial distress.

Industry body Cellular

Operators Association of India (COAI) on Monday wrote to telecom minister Manoj

Sinha, urging that the Rs 35,000 crore input tax credit due to telcos from the

government be adjusted against spectrum payments and levies as a measure to

help carriers overcome financial distress.

The telecom sector is under immense financial stress...a further demand of Rs 92,000 crore will

dampen the sentiment of telecom operators and raising funds for broadband,

network expansion and Digital India will hit a significant roadblock. The

impact is not limited to telecom operators but will have a domino effect on the larger digital value chain. It's no secret that Vodafone is

saddled with boatloads of debt. It’s borrowed too much money and is now at the

risk of collapse. Vodafone CEO, Nick Read, admitted that India has been a tough

market of late. He declared that the Company’s book value in India was probably

going to zero and pointed fingers at India’s unsupportive regulations,

crippling taxes and a supreme court decision that

left the carrier $4 billion in debt. In essence, this was perhaps an honest

admission that they might have to shut shop and leave India if there isn't some

sort of a government bailout.

Ambani has already infused Rs. 17,50,00,00,00,000 (Rs. 1.75 Lakh Crores) in the war chest, the need of the

hour for Vodafone Idea is to consider a fund infusion to augment its network

capabilities and provide effective competition but the Birlas have made it

clear that they are not infusing a penny more in the business. The company’s

exposure is highest, given its relatively weaker infrastructure. Of course,

much also depends on the final outcome of the AGR (adjusted gross revenues)-

related dispute with the government and the tariff hikes. While

the tariff hikes will certainly give the firm breathing space—for one, its rate

of cash burn will reduce— But given the fast pace of its market share losses,

it would need to do much more to retain the gains from the tariff hike.

While

a reprieve will certainly help, Vodafone Idea’s future depends on many other

things falling in place as well, and the company’s ability and willingness to

make the most of this sudden reversal in fortunes (the current tariff hikes)

for the telecom sector.

It doesn’t look like the telecom industry is gearing up to come at terms any time soon. There’s bad blood here. Let's wait and watch.

It doesn’t look like the telecom industry is gearing up to come at terms any time soon. There’s bad blood here. Let's wait and watch.

Comments

Post a Comment