A Double Irish With a Dutch Sandwich for the Tax Lovers!

According to Investopedia:

"The double Irish with a Dutch sandwich is a tax avoidance technique employed by certain large corporations, involving the use of a combination of Irish and Dutch subsidiary companies to shift profits to low or no-tax jurisdictions. The technique has made it possible for certain corporations to reduce their overall corporate tax rates dramatically."

Here is how the Double Irish Dutch Sandwich works:

First, we set up two Irish corporations and a Dutch corporation.

Then, you send profits through the first Irish company.

Those profits are then paid to a Dutch company.

Finally, the profits are moved to a second Irish company that has its headquarters in a tax haven such as Bermuda, Nevis or the Cayman Islands, for example

This strategy has allowed certain companies to reduce corporate taxes to virtually zero. The word sandwich is used because of the modus operandi of these tax structures. The setup involves shifting revenue from one Irish subsidiary to a Dutch company with no employees, and then on to a Bermuda mailbox owned by another Ireland-registered company (i.e. another Irish Company).

Google uses two structures, known as a “Double Irish” and a “Dutch Sandwich,” to shield the majority of its international profits from taxation. It moved $19.2 billion to a Bermuda shell company in 2016, saving the company billions of dollars in taxes that year.

Google Ireland Ltd. collects most of the company’s international advertising revenue. It then transfers this money to Dutch subsidiary Google Netherlands Holdings BV. A Google subsidiary in Singapore that collects most of the company’s revenue in the APAC region does the same.

The Dutch company then transfers this money on to Google Ireland Holdings Unlimited, which has the right to license the search giant’s intellectual property outside the U.S. That company is based in Bermuda, which has no corporate income tax. The use of the two Irish entities gives the structure its Double Irish name and the use of the Netherlands subsidiary as a mediator between the two Irish companies is the Dutch Sandwich.

In 2018 Google moved 21.8 billion euros ($24.5 billion) through its Dutch holding company to Bermuda, up from 19.9 billion in 2017. Google said it would end the practice after 2019.

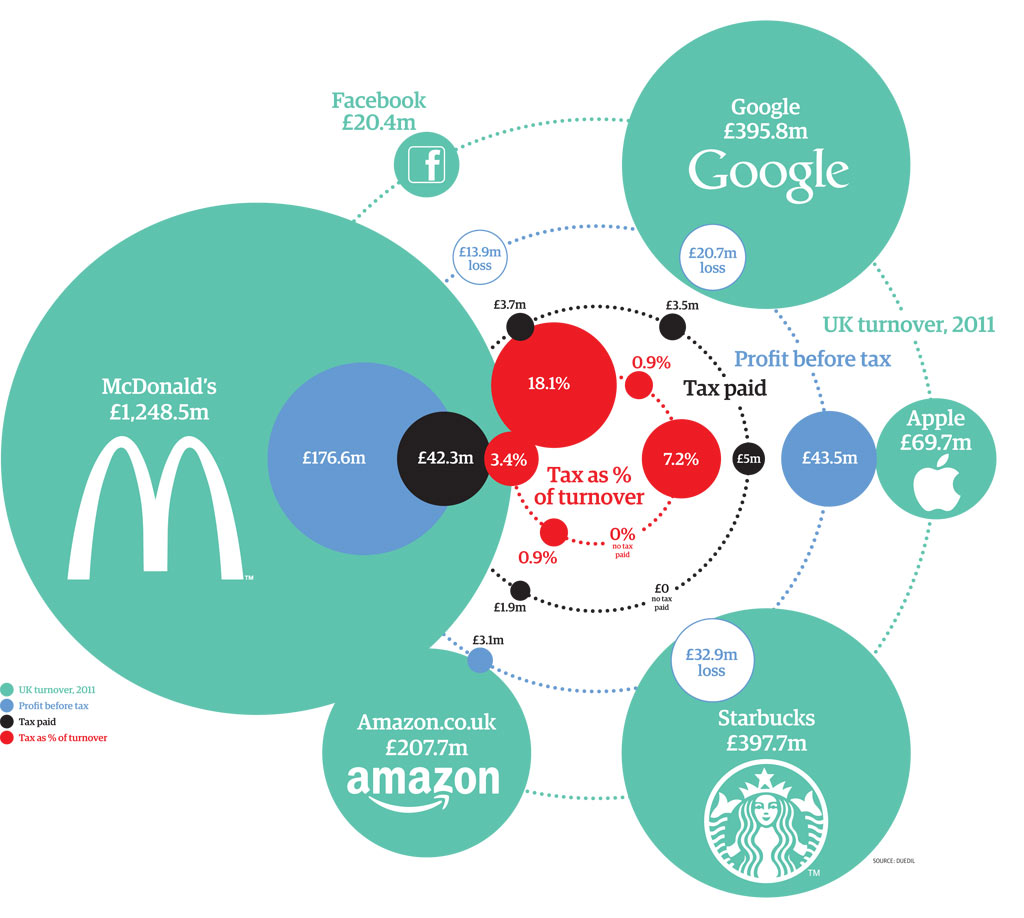

Several other international companies, such as Facebook and Apple, have located their European headquarters in the Republic of Ireland to take benefit from its low corporate tax rates.

Tim Cook, CEO of Apple Corporation, one of the most valuable companies in the world formed multiple offshore companies. He reported to the US Senate hearing on tax, two of its Irish subsidiaries pay about 2% in tax. One of the Irish subsidiaries of Apple got paid $29.9 billion in dividends from Apple-affiliated offshore companies from 2009 to 2012. This accounted for 30% of Apple’s global profits. Apple received the benefit of the difference between Irish and US tax residency laws.

The US authorities finally plugged the loopholes in 2015 and offered tech companies like Google a 5-year window (ending in 2020) to abandon these practices. And as part of that long-standing agreement, Google and many other international companies have finally decided to comply. So they're now moving on from the Double Irish Dutch Sandwich.

Let me know your thoughts in the comment section!

Good work, keep it up ����

ReplyDelete